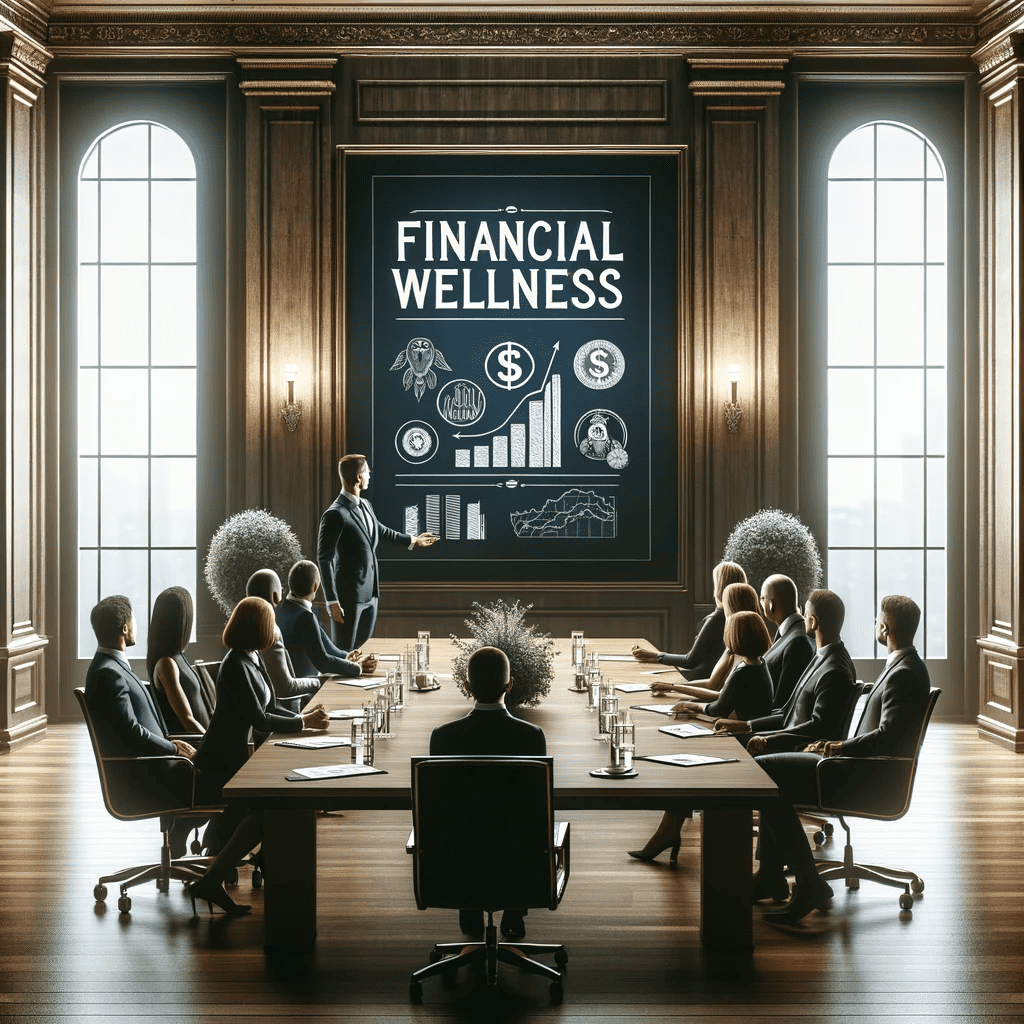

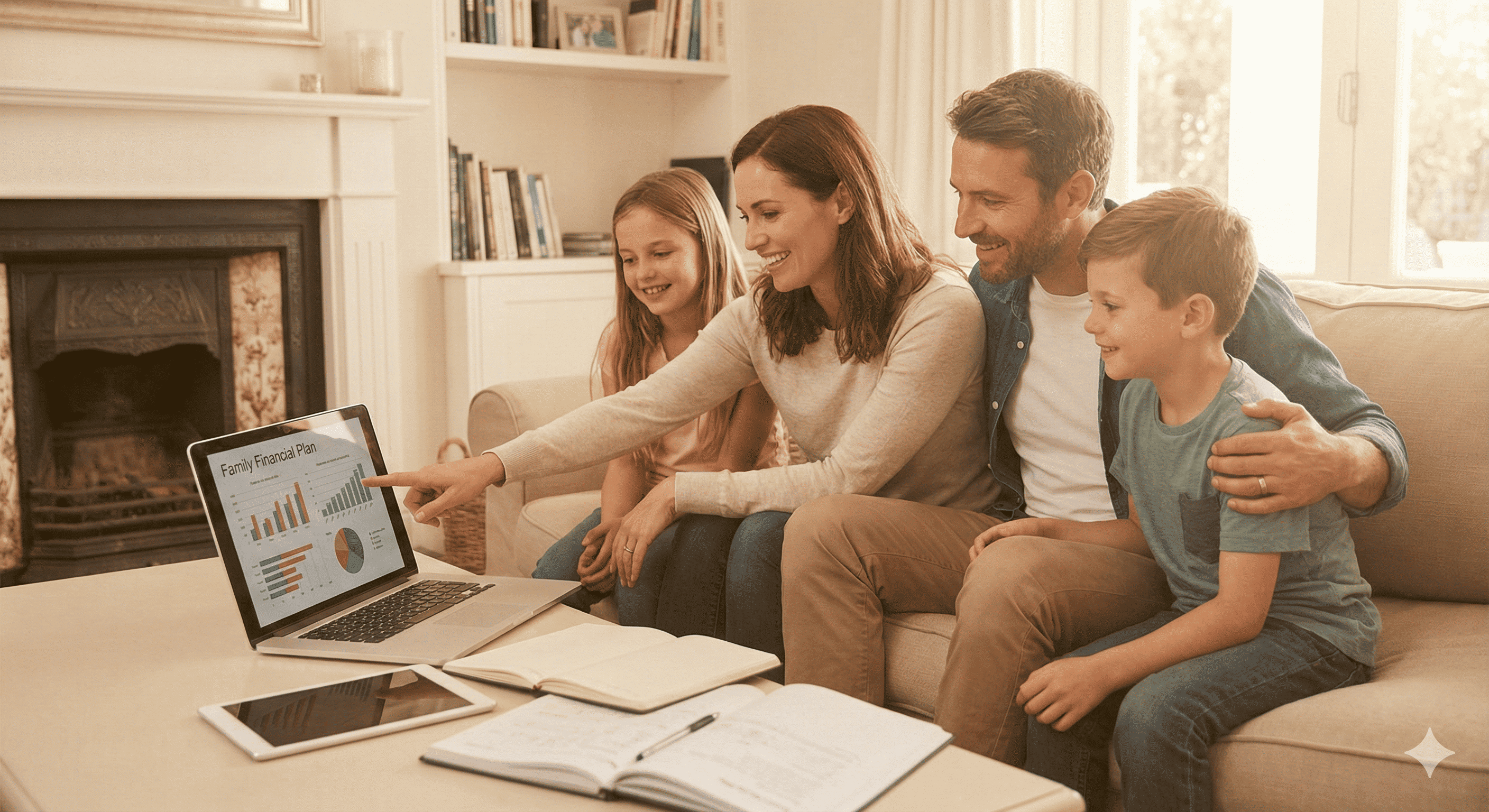

Financial Wellness Coaching

Master your finances. Achieve your goals. Live with confidence.

Loading

One-on-one coaching that connects your financial reality with your life purpose. From retirement planning to goal achievement—experience complete financial well-being tailored just for you.

Years of

Experience

We believe financial wellness is the most important life skill. Through one-on-one coaching and personalized plans, we help individuals master their finances and organizations build thriving, financially healthy teams. Our approach is objective, comprehensive, and focused on empowering you with the knowledge and strategies to achieve every financial goal.

Talk With Us

Years of

Experience

Certified Financial

Planner

Holistic Financial

Planning

Complete financial strategy covering investments, retirement, tax optimization, and wealth preservation.

Retirement. Education. Property. Travel. Achieve every milestone with realistic, actionable plans.

Safeguard your family, health, income, and assets with comprehensive insurance and risk planning.

Only trustworthy advice focused on your financial well-being and goals.

Empower individuals and organizations to achieve financial well-being through objective, comprehensive, personalized guidance.

Transform financial stress into confidence by making quality financial planning accessible to everyone.

Education over sales. Holistic planning over product pushing. Your success is our only measure.

Optimize loans, reduce EMI burden, and achieve debt-free status faster with strategic planning.

Wills, nominations, and estate strategies to protect your family's financial future.

Build 3-6 months expense reserves and optimize cashflow for complete financial stability.

Reduce tax burden through strategic planning while maximizing wealth creation legally.

05

Dec

05

Dec

Most families handle money reactively—paying bills, making random investments, buying insurance when pushed. Without a plan, you're navigating blind.

The solution: A written plan covering goals, timelines, required savings, risk coverage, and investment strategy—turning financial chaos into clarity.

03

Dec

03

Dec

Chasing past returns: Last year's top performer is rarely next year's winner. Timing the market: Trying to predict ups and downs destroys wealth.

The fix: Invest based on your goals and risk capacity, not market noise. Stay invested through cycles. Review annually, not daily.

01

Dec

01

Dec

How much: 3-6 months of essential expenses (rent, EMIs, groceries, bills). Where: Savings account, liquid funds—not equity or fixed deposits.

Why it matters: Job loss, medical emergency, urgent home repairs—life happens. An emergency fund prevents financial disasters.